- Blockchain Council

- January 03, 2025

Crypto AI Trading Bots

- An AI crypto trading bot is a software program that uses artificial intelligence (AI) algorithms to analyze market data, execute trades, and manage investment portfolios in the cryptocurrency market.

- These bots operate autonomously, without the need for constant human intervention, allowing traders to capitalize on market opportunities 24/7.

- They leverage advanced algorithms and machine learning techniques to make data-driven decisions, reducing emotional bias and increasing trading efficiency.

- AI crypto trading bots can be customized to suit individual trading goals, risk tolerances, and preferred trading strategies.

How do AI crypto trading bots work?

- AI crypto trading bots work by continuously monitoring cryptocurrency market data from various exchanges.

- They analyze market trends, price movements, trading volumes, and other relevant indicators to identify potential trading opportunities.

- Based on predefined parameters and trading strategies set by the user, these bots execute buy or sell orders automatically.

- Some bots also incorporate risk management features like stop-loss orders to minimize losses and maximize profits.

What are the benefits of using AI crypto trading bots?

- Increased efficiency: AI trading bots can execute trades much faster and more accurately than human traders, enabling users to capitalize on market movements instantly.

- Emotionless trading: Bots operate based on predefined algorithms, eliminating emotional bias and making rational decisions even in highly volatile market conditions.

- Diversification: Bots can trade across multiple cryptocurrency exchanges simultaneously, allowing users to diversify their investment portfolios and spread risk.

- 24/7 trading: AI trading bots can operate round the clock, ensuring that users never miss potential trading opportunities, even when they’re asleep or offline.

Are AI crypto trading bots safe to use?

- While AI crypto trading bots can offer many benefits, users should exercise caution and conduct thorough research before using them.

- It’s essential to choose reputable bot providers with a track record of reliability, security, and transparency.

- Users should ensure that the bot platform implements robust security measures, such as encryption, multi-factor authentication, and regular security audits.

- Additionally, users should start with small investments and carefully monitor bot performance, adjusting strategies as needed to mitigate risks and optimize returns.

What are the best AI crypto trading bots?

- The best AI crypto trading bots include 3Commas, Cryptohopper, and Kryll, known for their comprehensive features, user-friendly interfaces, and proven performance.

- These bots leverage artificial intelligence to analyze market trends, execute trades, and manage risk effectively.

- They cater to both novice and experienced traders in the cryptocurrency market.

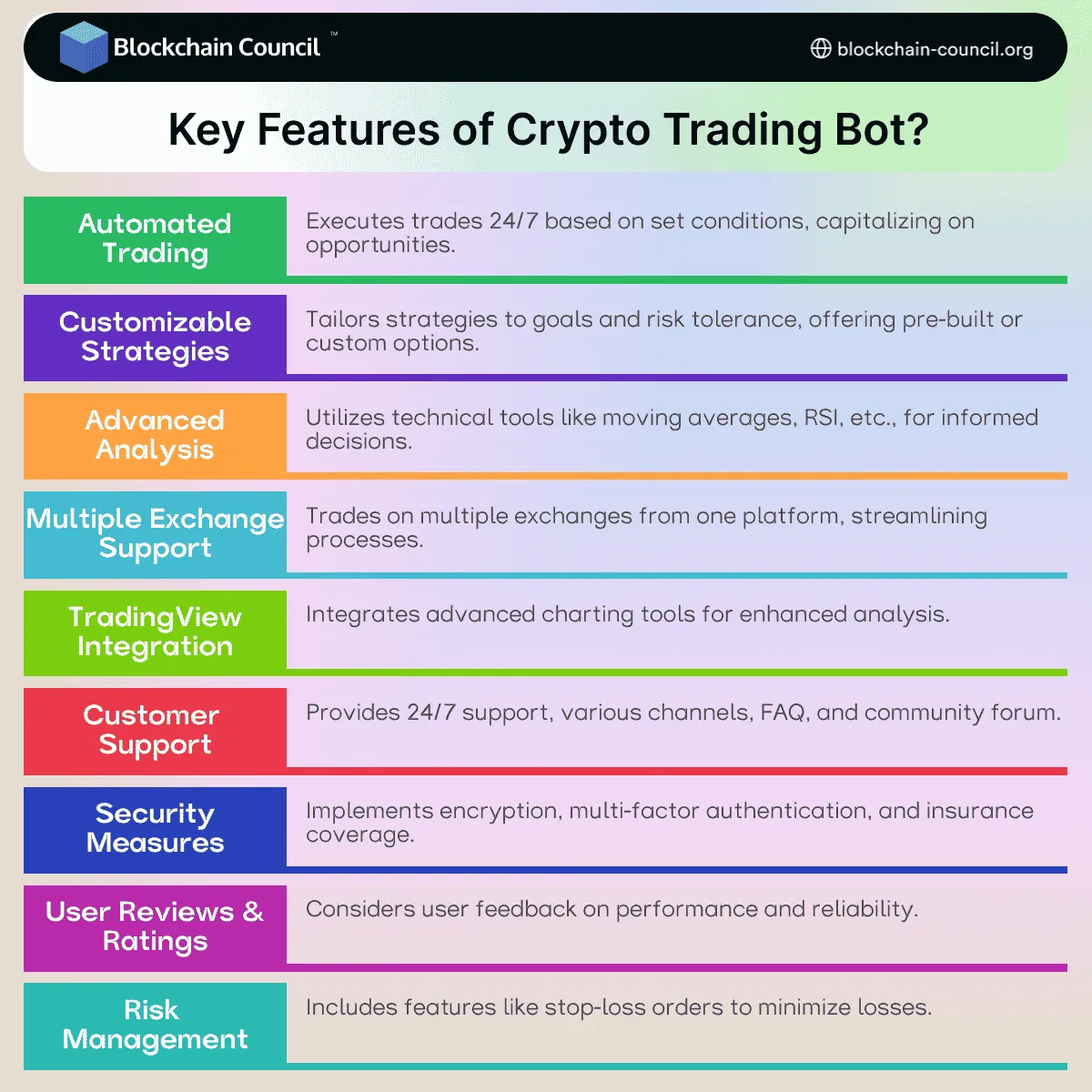

What are the Key Features of Crypto Trading Bot?

Also Read: How Can AI Be Used in Crypto Trading?

Top 10 AI Crypto Trading Bots

3Commas

3Commas is renowned for its comprehensive suite of trading tools and strategies, designed to automate and optimize crypto trading across various exchanges. The platform emphasizes security by using API keys and includes trade automation with proven performance bots like DCA, Grid, and Futures bots. These bots operate round the clock, ensuring you never miss a trading opportunity. Additionally, 3Commas provides detailed analytics, allowing traders to monitor and adjust their strategies for optimal performance. It supports trading on 14 major cryptocurrency exchanges, making it highly versatile and accessible..

Cryptohopper

Cryptohopper shines as a cloud-based trading bot, requiring no download or installation, ensuring a seamless trading experience. It is praised for its user-friendly interface and a range of features that cater to both beginners and experts. This platform stands out for its marketplace, strategy designer, customizable dashboard, and backtesting capabilities, similar to 3Commas. Cryptohopper’s approach to trading automation and strategy implementation makes it a strong competitor in the AI crypto trading bot space.

Kryll

Kryll is a comprehensive platform that empowers both novice and seasoned traders with its intuitive trading bot marketplace, sophisticated strategy editor, and robust portfolio management tools. It simplifies trading by allowing users to optimize their strategies for automated profits around the clock. The platform supports a variety of trading strategies including Market Trends, Trading Actions, and Signals, among others. Users can create, test, and deploy trading strategies without coding skills, leveraging a drag-and-drop interface for strategy building. Kryll also offers a unique feature integrating webhooks, enabling traders to connect external signals and TradingView scripts to automate trading further.

Dash2Trade

Dash2Trade stands out as a top-tier crypto analytics platform that enables traders to harness in-depth market insights. It’s built on the Ethereum Blockchain and revolves around the D2T token, which users can utilize to access its comprehensive dashboard. This platform facilitates the creation, backtesting, and optimization of trading strategies using DCA, grid, and indicator-based methods. Additionally, it offers exclusive crypto trading signals, advanced algorithms for grid bots, and DCA bots to automate crypto purchases. Dash2Trade aims to convert average crypto users into successful traders by lowering the entry barriers to various trading aspects and offering a wealth of unique market information. It offers a range of subscription plans, including a free tier for new users to get a feel for the platform.

Bybit

Bybit introduces a diverse range of automated trading bots to cater to various trading strategies, including Spot Grid, Futures Grid, and DCA (Dollar-Cost Averaging) bots. The Spot Grid Bot is particularly popular for its ability to operate in both sideways and volatile markets, executing buy low and sell high strategies automatically. The Futures Grid Bot, similar in function but with the added capability of leveraging investments up to 100x, amplifies both potential profits and risks. Meanwhile, the DCA Bot focuses on purchasing dips of selected cryptocurrencies, offering a more passive investment strategy suitable for bull and bear markets alike.

GunBot

GunBot stands out in the world of cryptocurrency trading with its unparalleled customization options and comprehensive strategies. With over 20 different buy and sell methods available, including utilizing Bollinger Bands for strategic buying and selling, users have the flexibility to adapt to ever-changing market conditions. Key features include diverse trading strategies accommodating various styles, unlimited crypto pairs for extensive market opportunities, and implementation of Dollar-Cost Averaging and reversal techniques for optimizing trades. It is compatible across multiple platforms and boasts an active community for support and knowledge sharing. Integration with Telegram allows for real-time notifications and trade monitoring, enhancing the trading experience..

Pionex

Pionex stands out in the crypto trading bot realm by seamlessly integrating bot technology within its exchange platform, providing users with a blend of automated and manual trading options. Noteworthy for its competitive trading fees of just 0.05% for both makers and takers, it appeals to traders of all levels. With support for over 350 cryptocurrency pairs, traders enjoy ample opportunities for portfolio diversification. Pionex offers 16 different bots, including Grid Trading, DCA, and Arbitrage bots, catering to various trading strategies. Additionally, as a licensed Money Services Business (MSB) registered with FinCEN, it prioritizes regulatory compliance and security, particularly for U.S. traders. The platform’s mobile app, available for both Android and iOS, ensures convenient trade and bot management on the go.

Learn2Trade

Learn2Trade stands out as a premier choice for automated crypto trading. It’s designed to offer around-the-clock trading opportunities by alerting users to profitable trades via Telegram. This bot operates autonomously, scanning the market for lucrative trades and notifying users instantly, thus eliminating the need to continuously monitor the markets. Compatible with leading exchanges, Learn2Trade facilitates automated trade execution without manual intervention. The setup process is straightforward, taking approximately 10 minutes. Users can expect up to 70 trades monthly with a claimed success rate of 79%. For those seeking to maximize their trading potential, Learn2Trade offers an integrated experience with Cornix, further simplifying the trading process through detailed setup instructions available on their platform.

Zignaly

Zignaly is recognized for its cost-effectiveness and comprehensive toolset for building or improving trading strategies. It supports both free and premium signals and boasts a significant user base. The platform utilizes Zigcoin (ZIG) to power its services, offering a blend of automated trading options and social trading features. Zignaly’s approachable design makes it an attractive option for nearly 500,000 investors. Operating on a cloud-based system ensures seamless updates without local installations, while compatibility with various cryptocurrencies ensures comprehensive market coverage. Zignaly’s emphasis on algorithmic decision-making fosters unbiased trading strategies, leveraging diverse signals to facilitate informed decision-making and visualizing strategies for intuitive trading actions.

Octobot

Octobot emerges as a leading AI-powered cryptocurrency trading bot, renowned for its dynamic nature and open-source framework catering to diverse trading strategies and platforms. Its adaptability allows users to tailor their experience, incorporating technical analysis, ChatGPT predictions, and TradingView automations. With support for both SPOT and Futures markets across 12 exchanges, Octobot showcases versatility in the crypto trading landscape. Key features include highly customizable strategies, AI integration with machine learning libraries, broad accessibility through open-source strategies, effortless installation options, and wide exchange compatibility via the ccxt library. Octobot fosters a vibrant community of over 25,000 users worldwide, promoting active engagement and ongoing innovation through platforms like Telegram and Discord. Recent updates have propelled Octobot to version 1.0.8, underscoring its commitment to continuous improvement and compatibility across various operating systems.

The Current Crypto Landscape and Importance of AI Crypto Trading Bots

The current crypto landscape, as we step into 2025, reveals a market in transition. Following a period characterized by rapid growth and innovation, the focus has now shifted towards the integration of decentralized technologies across various sectors, including gaming, DeFi (Decentralized Finance), and NFTs (Non-Fungible Tokens). Bitcoin is running bullish, breaking records almost everyday. Ethereum’s unwavering dominance in the smart contract platform space underscores the market’s inclination towards established, robust technologies that offer wide-ranging applicative potential and network effects.

Meanwhile, the evolution of layer-1 and layer-2 solutions underscores the continuous search for scalability and efficiency within the ecosystem. With a market that operates 24/7, the demand for tools that can monitor, analyze, and act on market movements around the clock has significantly increased. AI crypto trading bots meet this demand by providing automated, emotionless execution of trading strategies, thereby enabling traders to maximize their returns. The adoption of these bots has been facilitated by their ability to integrate with multiple cryptocurrency exchanges and to offer a range of strategies that cater to different risk tolerances and trading styles.

Conclusion

As we conclude our exploration of AI crypto trading bots, it’s clear that these sophisticated tools are revolutionizing the way we engage with the cryptocurrency market. The continuous advancements in AI and machine learning have made it possible for trading bots to not only execute trades based on predefined parameters but also to learn from market conditions and adapt their strategies in real-time, offering traders a powerful tool to enhance their trading outcomes. As the crypto market continues to mature and evolve, the integration of AI into trading strategies will undoubtedly become more prevalent. The landscape is ripe with opportunities for those who leverage the right tools to navigate its complexities.

For traders looking to navigate the complex and volatile world of cryptocurrency trading, selecting the right AI trading bot can be a game-changer. It’s essential to consider factors such as the bot’s compatibility with preferred exchanges, the availability of demo trading for practice, the flexibility of strategies it offers, and the level of support and educational resources provided. As we’ve seen, the market is not only about identifying opportunities but also about the timely and effective execution of trades. With the right AI trading bot, traders can leverage the power of artificial intelligence to make informed decisions, adapt to market changes swiftly, and ultimately achieve their trading goals with greater efficiency and profitability.

Guides

Guides News

News Blockchain

Blockchain Cryptocurrency

& Digital Assets

Cryptocurrency

& Digital Assets Web3

Web3 Metaverse & NFTs

Metaverse & NFTs