- Blockchain Council

- May 10, 2024

Summary

- NFTs (Non-Fungible Tokens) have gained popularity in the world of cryptocurrencies.

- NFT ownership doubled in 2022, reaching 9.3 billion from 4.6 billion in 2021.

- NFT Gas Fees are a crucial aspect of NFT transactions.

- NFT Gas Fees are paid to incentivize miners to process NFT transactions.

- These fees serve purposes like security, resource allocation, and decentralization.

- Factors affecting NFT Gas Fees include network congestion, gas price, smart contract complexity, and the type of NFT transaction.

- You can calculate NFT Gas Fees using Gas Price and Gas Limit.

- Alternative Blockchains like Solana, Avalanche, Cardano, Polygon, Fantom, Flow, Tezos, and WAX offer lower NFT Gas Fees compared to Ethereum.

- Tips to minimize NFT Gas Fees include choosing off-peak hours, monitoring gas prices, using lazy minting, and utilizing gas tracking tools.

- Smart contract optimization, bundling transactions, and choosing the right NFT platform are strategies to reduce NFT Gas Fees.

Introduction

In the world of cryptocurrencies and Blockchain technology, NFTs (Non-Fungible Tokens) have taken the digital realm by storm. Despite the crypto winter of 2022, the total NFT ownership almost doubled in 2022, reaching 9.3 billion from 4.6 billion in 2021. These unique digital assets have transformed the way we perceive ownership and digital content. However, behind the scenes, there’s a crucial aspect that every NFT enthusiast should be aware of – NFT Gas Fees.

So, what is NFT Gas Fee? How to calculate it? By the end of this article, you will get the answers to these questions. So, let’s get started!

Why Should You Know About NFT Gas Fees?

Understanding NFT Gas Fees is paramount for anyone involved in the NFT space, from beginners exploring their first digital collectibles to seasoned professionals managing high-value digital assets.

The average gas fee for minting an NFT on Ethereum currently stands at around $100. However, it’s important to note that NFT Gas Fees can vary significantly depending on network traffic and the complexity of the NFT being minted.

High NFT Gas Fees have been a major barrier to entry for many people interested in NFTs. In fact, a recent study found that 43% of NFT buyers have abandoned a purchase due to high NFT Gas Fees, underscoring the real impact of these costs on NFT adoption. So, isn’t there a way to reduce NFT Gas Fees? There are several ways to reduce NFT Gas Fees, and we will discuss them in the later sections of this article. But to begin with:

Why NFT Gas Fees Matter

Understanding NFT Gas Fees is paramount for anyone involved in the NFT space, from beginners exploring their first digital collectibles to seasoned professionals managing high-value digital assets. The importance of NFT Gas Fees can be broken down into several key points:

- Transaction Execution: Whenever you buy, sell, or trade NFTs, the associated transactions require Gas. Knowing how NFT Gas Fees work ensures that your transactions are processed efficiently and without unnecessary delays.

- Cost Management: NFT Gas Fees can vary widely, and during peak network congestion, they can skyrocket. Being aware of how to calculate and manage these fees can save you money and prevent unexpected expenses.

- Timely Decisions: In a dynamic NFT marketplace, timing is critical. Understanding NFT Gas Fees allows you to make informed decisions about when to buy or sell, optimizing your investments.

- Smart Contract Interactions: NFTs often involve smart contracts that require Gas for execution. Knowing how NFT Gas Fees affect these interactions is vital, especially if you’re creating or interacting with more complex NFTs.

Understanding Gas in the NFT World

What is Gas in Cryptocurrency?

Gas in the cryptocurrency realm is akin to the fuel you put in your car to make it run. It’s a measure of computational work required to execute transactions or smart contracts on a Blockchain network, primarily the Ethereum Blockchain in the case of NFTs. Think of it as the energy needed to power the decentralized engine that drives these transactions.

When you initiate any action on the Blockchain, such as buying or selling an NFT, you’re essentially asking the network to perform certain calculations and validate your transaction. These computations consume computational resources, and this is where Gas comes into play.

What is NFT Gas Fee?

Now, let’s zoom in on NFT transactions. When you decide to purchase a digital artwork, a collectible, or any NFT, the network needs to perform a series of operations. These operations include verifying the ownership of the NFT, transferring it to your wallet, and updating the transaction history on the Blockchain.

Each of these operations requires computational power, and here’s where Gas steps in again. You pay a certain amount of Gas to incentivize miners, who are the network’s workers, to prioritize your transaction over others. The more complex the transaction, the more Gas is required.

Why NFTs Use Gas

You might wonder why NFTs use Gas in the first place. The answer lies in maintaining the security, decentralization, and integrity of Blockchain networks. By requiring users to pay NFT Gas Fees, it discourages spam transactions and ensures that those who want their transactions processed are willing to compensate the network participants fairly.

Moreover, the use of NFT Gas Fees in NFT transactions also helps prioritize transactions on the Blockchain. Users can choose to pay higher or lower NFT Gas Fees based on how urgently they want their transactions to be processed. This competitive fee structure ensures that the most critical and time-sensitive transactions take precedence. Therefore, NFTs use Gas for several essential reasons:

- Security: NFT Gas Fees help prevent spam and ensure that only legitimate transactions are added to the Blockchain. By imposing a cost, it discourages malicious actors from overloading the network with unnecessary transactions.

- Resource Allocation: NFT Gas Fees allocate resources fairly on the Blockchain. Transactions that require more computational power pay higher fees, ensuring that critical transactions get processed promptly.

- Decentralization: NFT Gas Fees incentivize miners and validators in a Blockchain’s decentralized network to maintain and secure the network. They earn these fees for their work, which keeps the system robust and decentralized.

Factors Influencing NFT Gas Fees

Network Congestion

Imagine a highway during rush hour – the more traffic, the slower the journey. Similarly, on Blockchain networks, the level of network congestion significantly impacts NFT Gas Fees. When many users are transacting on the same Blockchain simultaneously, the network becomes congested, causing delays and driving up NFT Gas Fees.

Gas Price

Gas is the fuel that powers transactions on Blockchain networks. Its price varies depending on demand and network congestion. To get your NFT transaction processed quickly, you may need to set a higher gas price, which, in turn, increases the cost of your transaction. Conversely, during periods of lower demand, you can opt for a lower gas price, reducing your transaction costs.

Smart Contract Complexity

NFTs often rely on smart contracts, self-executing contracts with predefined rules. The complexity of these smart contracts can impact NFT Gas Fees. Intricate contracts that require more computational resources will result in higher NFT Gas Fees. Conversely, simpler contracts demand fewer resources and incur lower fees.

Type of NFT Transaction (Minting, Buying, Selling)

The type of NFT transaction you engage in also plays a role in determining NFT Gas Fees:

- Minting NFTs: Creating new NFTs, known as minting, can be a gas-intensive process. The complexity of the NFT and the Blockchain’s current state influence minting NFT Gas Fees.

- Buying NFTs: Purchasing existing NFTs generally incurs lower NFT Gas Fees compared to minting. You’re essentially transferring ownership, which is a more straightforward transaction.

- Selling NFTs: When selling an NFT, you may need to approve the transfer through a smart contract. This approval process incurs its own set of NFT Gas Fees.

How to Calculate NFT Gas Fees?

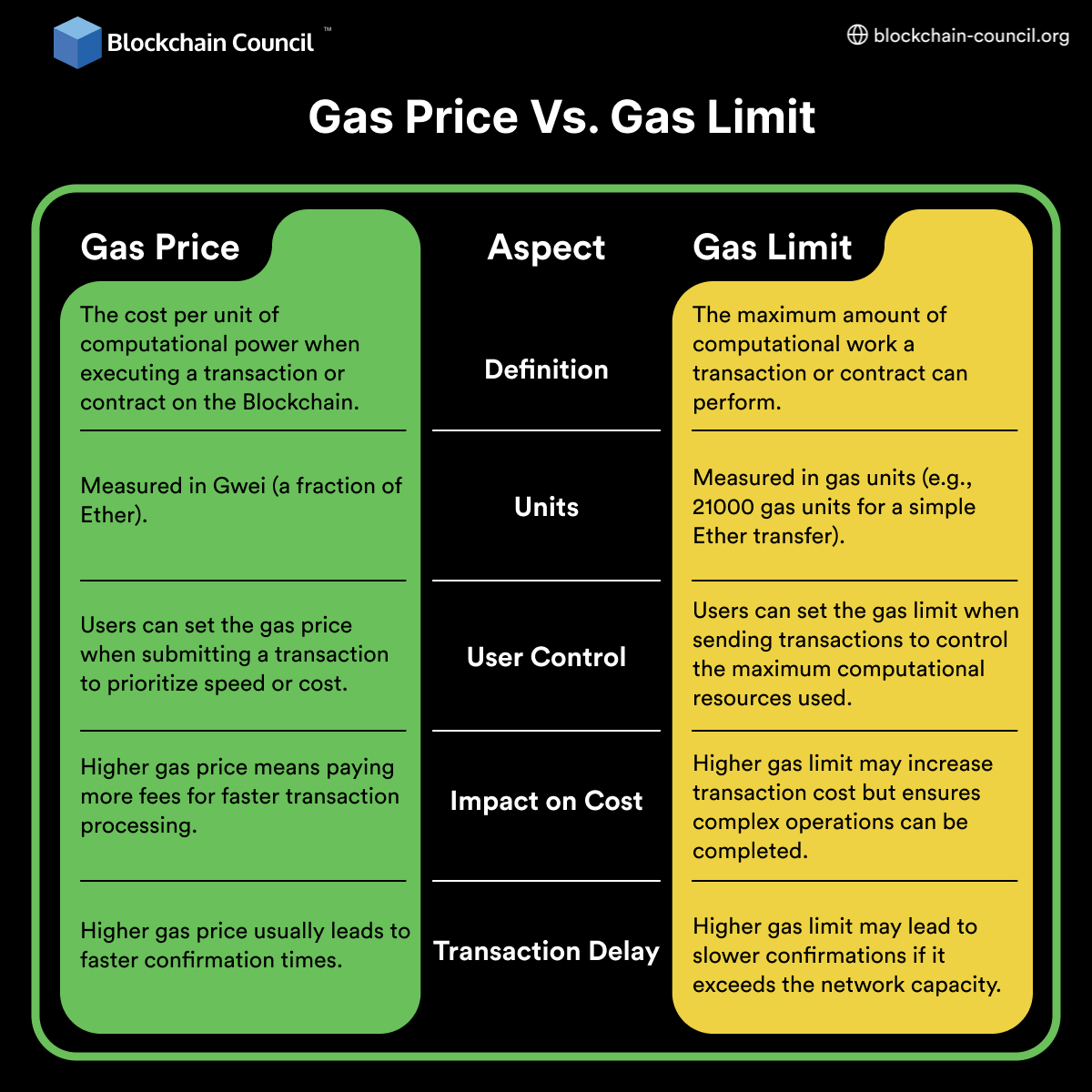

To calculate NFT Gas Fees, we need to explore two fundamental concepts: Gas Price and Gas Limit. These terms may sound technical, but they are the building blocks of understanding how much you’ll pay for your NFT transactions.

Gas Price Vs. Gas Limit

Gas Price: Think of Gas Price as the cost per unit of computational work on the Blockchain. It’s like the price of fuel for your car. The higher the Gas Price, the more you pay for each operation in your transaction.

Gas Limit: Gas Limit, on the other hand, is the maximum amount of gas you’re willing to spend on a transaction. It’s like setting a budget for your journey. If you set a high Gas Limit, you’re prepared to spend more to ensure your transaction is processed swiftly.

Now, here’s the connection: Gas Fee, the total cost of your NFT transaction, is determined by multiplying the Gas Price by the Gas Limit. So, choosing the right combination of these two factors is crucial.

Let’s break it down with a simple example:

Imagine you’re buying an NFT with a Gas Price of 50 Gwei (a unit of Ethereum’s cryptocurrency) and a Gas Limit of 100,000. Your Gas Fee would be:

Gas Fee = Gas Price x Gas Limit Gas Fee = 50 Gwei x 100,000 = 5,000,000 Gwei

Formula for Calculating NFT Gas Fees

Now, you may wonder how to convert this NFT Gas Fee into a more familiar currency, like Ethereum (ETH). To do this, you’ll need to convert Gwei to ETH. Here’s a straightforward formula for that:

Gas Fee (in ETH) = (Gas Price (in Gwei) x Gas Limit) / 1,000,000,000

So, in our example:

Gas Fee (in ETH) = (50 Gwei x 100,000) / 1,000,000,000 = 0.00005 ETH

This formula allows you to estimate the cost of your NFT transactions in ETH, making it easier to plan your budget effectively.

Real-Life Examples

Let’s put this knowledge into action with some real-life scenarios:

Scenario 1: Buying an NFT You’re eyeing a digital artwork priced at 0.1 ETH. To ensure a quick transaction, you set a Gas Price of 60 Gwei and a Gas Limit of 150,000.

Gas Fee = (60 Gwei x 150,000) / 1,000,000,000 = 0.00009 ETH

So, your total cost for buying the NFT would be 0.1 ETH + 0.00009 ETH = 0.10009 ETH.

Scenario 2: Participating in an NFT Auction You’re in a bidding war for a rare collectible. To outbid your competitors, you set a higher Gas Price of 70 Gwei but maintain a conservative Gas Limit of 100,000.

Gas Fee = (70 Gwei x 100,000) / 1,000,000,000 = 0.00007 ETH

In this case, you’ll need to factor in the Gas Fee on top of your bid amount.

Ethereum vs. Other Blockchains

NFT Gas Fees on Ethereum

NFT Gas Fees on Ethereum are the fees paid to miners to process transactions on the network. They are calculated based on the amount of computational power required to execute a transaction. NFT Gas Fees are typically quoted in gwei, which is a denomination of ETH. Each gwei is equal to one-billionth of an ETH.

The average gas fee on Ethereum currently stands at around 10.39 gwei. This means that a transaction that costs 10,000 gas would cost around 0.0001039 ETH. However, NFT Gas Fees can vary significantly depending on the complexity of the transaction and the current network congestion. For example, during times of high network congestion, NFT Gas Fees can spike to several hundred gwei.

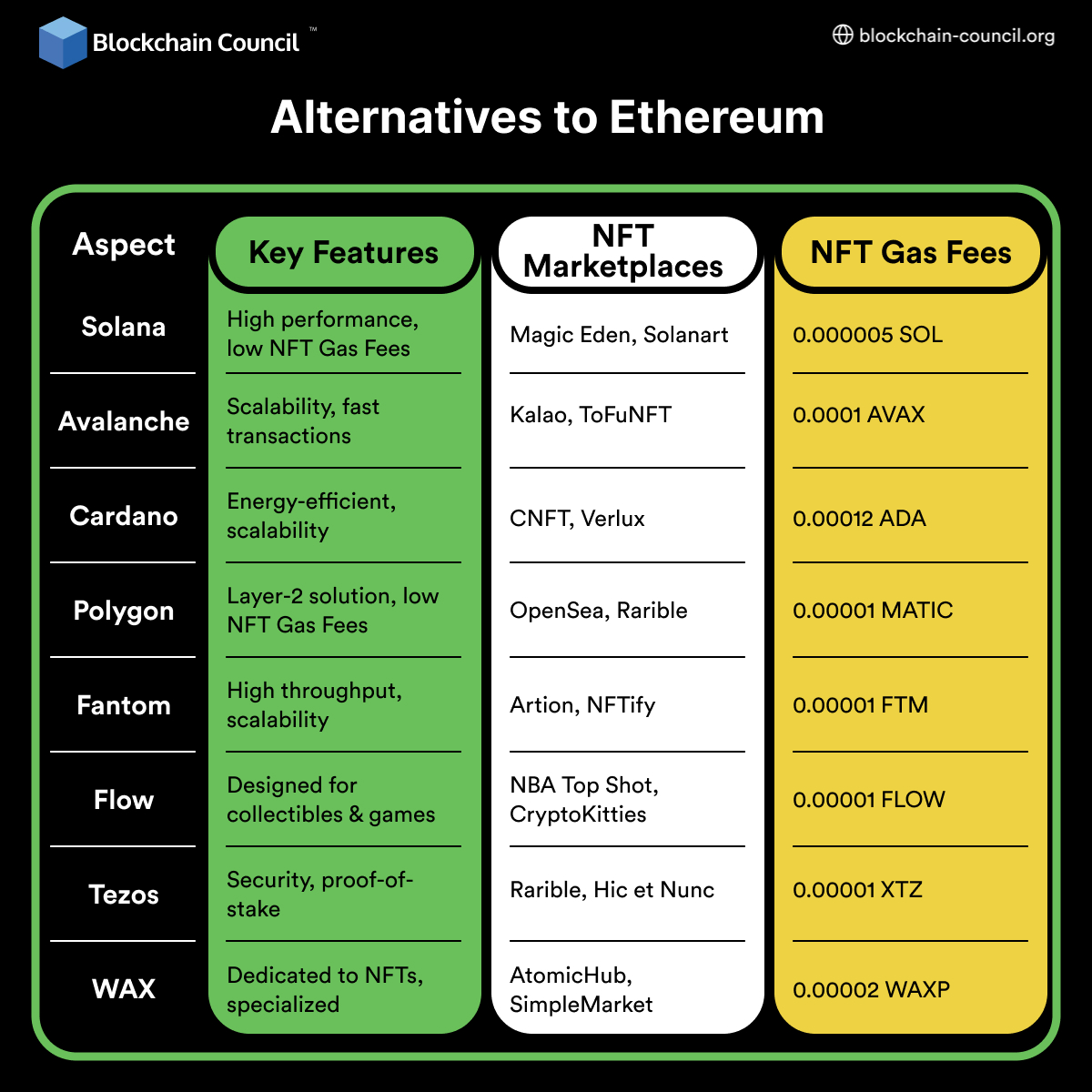

Alternatives to Ethereum

In the ever-expanding world of NFTs, Ethereum may be the trailblazer, but it’s not the only option. Several alternative Blockchains have emerged, each offering unique advantages along with their associated NFT Gas Fees:

- Solana: Solana is a high-performance Blockchain capable of processing thousands of transactions per second with remarkable energy efficiency. It boasts NFT marketplaces like Magic Eden and Solanart, making it an attractive option for creators and collectors seeking fast and cost-effective transactions, with NFT Gas Fees as low as 0.000005 SOL.

- Avalanche: With its ability to handle thousands of transactions per second and strong scalability, Avalanche is another compelling choice. NFT marketplaces such as Kalao and ToFuNFT thrive on this Blockchain, providing a vibrant ecosystem for NFT enthusiasts, with NFT Gas Fees around 0.0001 AVAX.

- Cardano: Known for its energy-efficient proof-of-stake mechanism and scalability, Cardano has its share of NFT marketplaces, including CNFT and Verlux. It offers a sustainable and efficient platform for NFT creators, with NFT Gas Fees approximately at 0.00012 ADA.

- Polygon: As a layer-2 solution for Ethereum, Polygon offers lower NFT Gas Fees and faster transaction speeds. NFT marketplaces like OpenSea and Rarible have found a home here, providing a seamless experience for NFT enthusiasts looking to avoid high Ethereum NFT Gas Fees, with NFT Gas Fees as low as 0.00001 MATIC.

- Fantom: Fantom, known for its high throughput and scalability, can process thousands of transactions per second. NFT marketplaces such as Artion and NFTify have flourished on this Blockchain, offering a competitive alternative to Ethereum, with NFT Gas Fees approximately at 0.00001 FTM.

- Flow: Designed specifically for digital collectibles and games, Flow has gained recognition with NFT marketplaces like NBA Top Shot and CryptoKitties. It offers a unique ecosystem for collectors and gamers, with NFT Gas Fees around 0.00001 FLOW.

- Tezos: Praised for its security and efficiency within the proof-of-stake realm, Tezos hosts NFT marketplaces like Rarible and Hic et Nunc. It’s an excellent choice for those seeking a secure and environmentally friendly NFT platform, with NFT Gas Fees at approximately 0.00001 XTZ.

- WAX: Tailored for NFTs, WAX features NFT marketplaces such as AtomicHub and SimpleMarket. It’s a Blockchain dedicated to the NFT world, providing specialized services and a thriving marketplace, with NFT Gas Fees around 0.00002 WAXP.

Tips to Minimize NFT Gas Fees

Tips to Reduce NFT Gas Fees

When it comes to minimizing NFT Gas Fees, timing is everything. NFT Gas Fees on the Ethereum network can fluctuate wildly based on network congestion. Here are some tips on when to make your NFT transactions to save on NFT Gas Fees:

- Off-Peak Hours: Gas prices tend to be lower during off-peak hours. These hours can vary depending on your time zone, but they generally occur late at night or early in the morning when there are fewer users actively transacting on the network. You can check historical gas prices to identify these off-peak periods.

- Weekend Advantage: Weekends are often a prime opportunity to save on NFT Gas Fees. Ethereum network activity typically decreases during weekends, leading to lower gas prices. If you have the flexibility to choose when you mint or trade NFTs, consider doing so on Saturdays or Sundays.

- Monitoring Tools: To pinpoint the ideal time for your transactions, make use of gas tracking and monitoring tools. These tools provide real-time data on gas prices, allowing you to spot periods of low congestion. Keep in mind that gas prices can change rapidly, so staying updated is crucial.

- Lazy Minting Marketplaces: Lazy minting marketplaces like OpenSea have emerged as a savvy way to reduce NFT Gas Fees. Unlike traditional minting processes, where you pay NFT Gas Fees upfront to create an NFT, lazy minting allows you to mint NFTs at the time of purchase. This means you only incur NFT Gas Fees when there’s a buyer, reducing the upfront cost for creators and collectors.

Using Gas Tracking Tools

Staying informed about current gas prices is essential for optimizing your NFT transactions. Gas tracking tools provide real-time data on NFT Gas Fees, helping you make informed decisions. Here are a few popular ones:

Gas tracking tools often provide estimates for different transaction speeds, such as slow, standard, and fast. Depending on your urgency, you can choose an appropriate transaction speed that balances cost and confirmation time. Keep in mind that faster transactions typically require higher NFT Gas Fees.

Some cryptocurrency wallets integrate gas tracking features directly into their interfaces. When making NFT transactions, use wallets that offer this functionality. They often display real-time gas prices and allow you to set custom NFT Gas Fees based on your preferences.

Smart Contract Optimization

Smart contract optimization is a critical aspect of reducing NFT Gas Fees.Consider the following::

- Gas-Efficient Code: Collaborate with developers experienced in writing gas-efficient smart contracts. Efficiently coded contracts can significantly reduce the NFT Gas Fees associated with minting, transferring, or interacting with NFTs. Optimized code minimizes unnecessary computations and storage, which translates into lower fees.

- Gas Estimation: Utilize gas estimation tools or libraries when developing smart contracts. These tools help you estimate the gas consumption of your contract functions before deployment, allowing you to make informed decisions about NFT Gas Fees. Gas estimation can prevent unexpected cost overruns.

- Layer 2 Solutions: Consider implementing Layer 2 scaling solutions. These solutions, such as Optimistic Rollups and zk-Rollups, enable off-chain processing of transactions, resulting in significantly lower NFT Gas Fees. Integrating Layer 2 can be a game-changer for NFT platforms aiming to provide cost-effective transactions for users.

Bundling Transactions

Bundling transactions is a strategic approach to optimizing NFT transactions. This approach can be particularly advantageous for those looking to save on NFT Gas Fees::

- Marketplace Integration: Some NFT marketplaces have built-in features that allow users to bundle multiple transactions into a single batch. This means you can combine multiple purchases or sales into a single transaction, reducing the overall NFT Gas Fees. When using a marketplace that offers this feature, take full advantage of it.

- Third-Party Services: In cases where your chosen NFT marketplace doesn’t provide built-in bundling options, you can turn to third-party services. These services specialize in optimizing transactions by bundling them efficiently. They handle the technical details, ensuring that your transactions are cost-effective and executed seamlessly.

Reducing Gas Fee Strategies for NFT Investors

Long-Term Holding vs. Frequent Trading

Long-Term Holding

For many NFT investors, adopting a long-term holding strategy can be a wise choice. This approach involves acquiring NFTs with the intention of keeping them in your digital wallet for an extended period. By doing so, you can mitigate the impact of high NFT Gas Fees associated with frequent trading.

Long-term holders often target NFTs with strong utility, rarity, or sentimental value. These assets are seen as potential gems that may appreciate significantly over time, making the initial NFT Gas Fees a worthwhile investment.

Frequent Trading

On the other hand, frequent trading in the NFT space is akin to active stock trading. It involves buying and selling NFTs more frequently, often capitalizing on short-term market fluctuations. While this approach can yield quick profits, it’s essential to be aware of the associated NFT Gas Fees, which can accumulate rapidly with each trade.

Investors pursuing frequent trading strategies need to closely monitor gas prices, market trends, and potential profit margins. Timing is critical in this scenario, as executing trades during periods of lower NFT Gas Fees can significantly impact overall profitability.

Predicting and Mitigating High NFT Gas Fees

Predicting gas fee fluctuations on the Ethereum Blockchain, where many NFTs are minted and traded, can be challenging. Gas prices vary based on network congestion, and they can skyrocket during periods of high demand, such as a popular NFT drop or a surge in DeFi activity.

To mitigate the impact of high NFT Gas Fees, NFT investors should consider the following strategies:

- Gas Fee Trackers: Utilize gas fee tracking websites and tools to stay informed about real-time gas prices. These platforms provide insights into current fees and historical trends.

- Scheduled Transactions: Plan your NFT transactions during off-peak hours when NFT Gas Fees are typically lower. This requires some patience but can save you a significant amount over time.

- Layer 2 Solutions: Explore layer 2 scaling solutions like Polygon (formerly Matic) or Optimism. These technologies offer faster and cheaper transactions while still being connected to the Ethereum network.

- Batch Transactions: Combine multiple transactions into one to optimize gas usage. This is particularly useful for NFT artists minting multiple tokens simultaneously.

- Gas Price Estimators: Use gas price estimator tools to set the right gas price for your transaction. This can help you avoid overpaying during periods of high congestion.

Balancing Gas Costs with Investment Gains

Balancing gas costs with investment gains is a crucial aspect of NFT investing. To ensure that NFT Gas Fees don’t eat into your profits, consider the following tips:

- Calculate ROI: Before investing in an NFT, calculate the potential return on investment (ROI). Ensure that the expected gains outweigh the NFT Gas Fees incurred during the transaction.

- Diversify: Diversify your NFT portfolio to spread the risk. This way, the success of one NFT can offset the losses or fees incurred by others.

- Cost-Benefit Analysis: Conduct a cost-benefit analysis for each transaction. Assess whether the NFT Gas Fees are justified by the potential value appreciation of the NFT.

- Stay Informed: Keep yourself updated on gas fee trends and Blockchain developments. Being proactive can help you make informed decisions.

Now let’s find out some expert tips and tricks to reduce NFT Gas Fees!

Reducing Gas Fee Strategies for Artists

Gas Fee Estimators

Before you take any action, utilize a gas fee estimator. This handy tool provides a clear picture of the impending costs associated with listing your artwork or making a purchase. Armed with this knowledge, you can avoid unwelcome surprises and budget accordingly.

Bundle Transactions for Maximum Savings

If you’re dealing with multiple artworks or purchases, consider bundling them into a single transaction. This simple tactic can substantially reduce your NFT Gas Fees, making it a cost-effective choice for artists looking to optimize their expenses.

Choose the Right Marketplace

Different marketplaces have varying fee structures, and some offer lower NFT Gas Fees than others. Conduct thorough research to identify the marketplace that aligns with your transaction needs, ensuring you pay the lowest possible fees for your chosen platform.

Layer-2 Solutions

Layer-2 solutions are a game-changer for artists seeking to cut down on NFT Gas Fees. These protocols process transactions off-chain, significantly reducing associated costs. Take the time to explore the diverse range of layer-2 solutions available, selecting one that best suits your unique requirements.

Choose a Gas-Fee Aware Wallet

Your choice of wallet can make a significant difference in managing NFT Gas Fees. Opt for a wallet that provides real-time information on gas prices and allows you to customize your transaction fees accordingly. This way, you can make informed decisions to optimize costs.

Gas Tokens

Gas tokens, like “CHI” on Ethereum, can be a savvy strategy. By pre-purchasing gas when fees are low and using it later when fees spike, artists can potentially save a substantial amount in transaction costs.

Wait for Lower NFT Gas Fees

NFT Gas Fees are dynamic and can fluctuate based on network activity and time of day. If your transactions aren’t time-sensitive, exercise patience and wait for lower NFT Gas Fees. Timing your actions strategically can lead to substantial savings.

Price Your Artwork Strategically

Listing your artwork at a slightly lower price might seem counterintuitive, but it can attract buyers willing to pay NFT Gas Fees, ultimately resulting in quicker sales and potentially higher overall earnings.

Offer Free Shipping

Consider including free shipping in your listings to entice buyers. However, keep in mind that you should account for NFT Gas Fees when calculating shipping costs to maintain profitability.

Accept Multiple Payment Methods

Diversify your payment options by accepting various methods like credit cards, PayPal, and cryptocurrency. Each payment method incurs different NFT Gas Fees, allowing you to provide flexibility to your buyers while minimizing costs on your end.

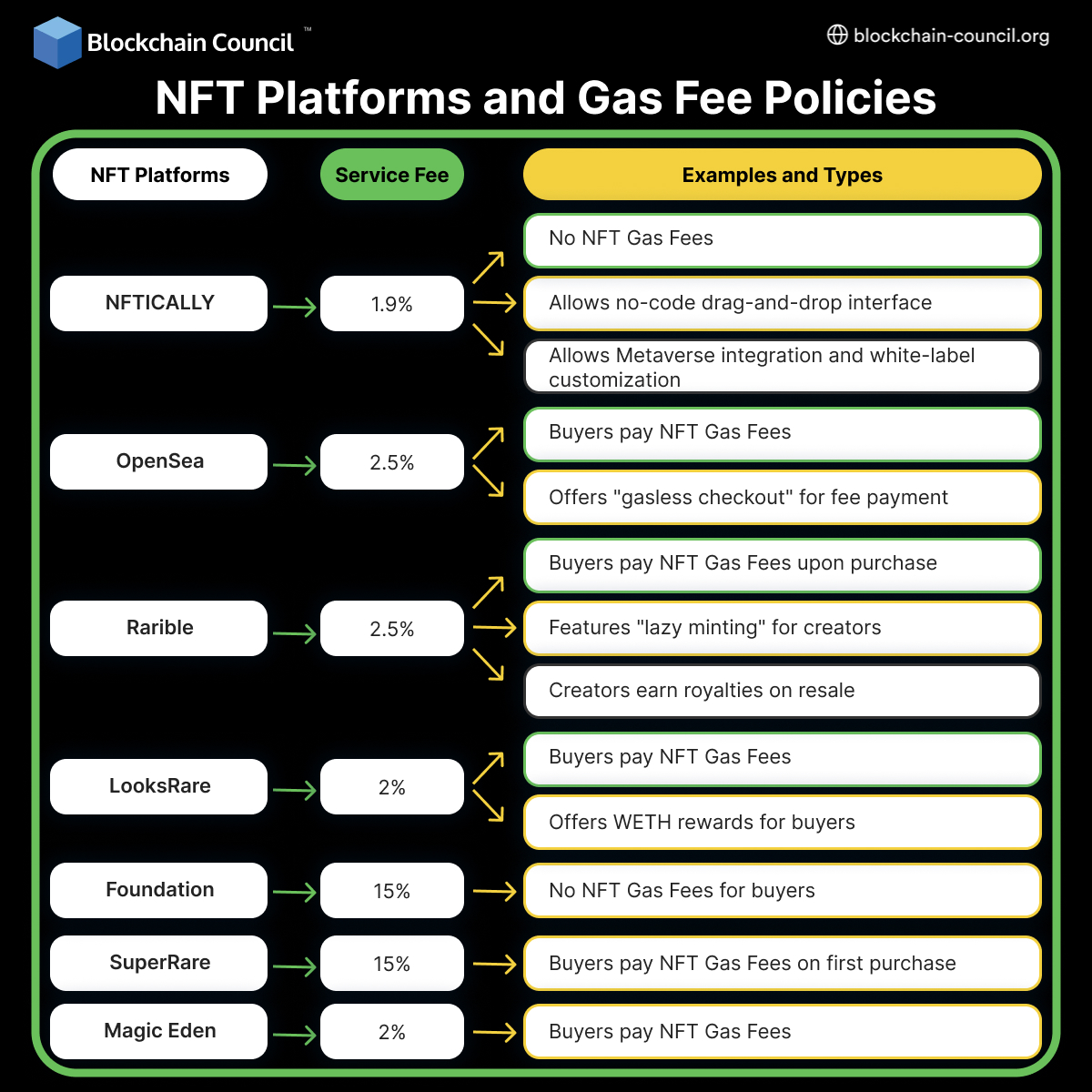

NFT Platforms and Gas Fee Policies

NFTICALLY

- NFTICALLY is a drag-and-drop platform, so anyone can create and run their NFT store without coding.

- White-label customization: Users can personalize their store’s appearance to align with their brand (white-label customization).

- NFTICALLY accepts fiat payments, simplifying NFT transactions.

- The platform allows Metaverse integration. So, the users can showcase their NFTs in virtual environments.

- Users have to pay no gas-fees to create NFT on NFTICALLY.

OpenSea

- OpenSea is the largest NFT marketplace globally, with a user-friendly interface.

- It supports various NFT types, from art to gaming items, and has over 1 million NFTs listed.

- OpenSea charges a 2.5% service fee on all sales, and buyers are responsible for paying NFT Gas Fees.

- Notably, OpenSea offers a “gasless checkout” feature, allowing buyers to pay NFT Gas Fees later if their purchase is successful.

Rarible

- Rarible is a decentralized NFT marketplace that emphasizes community involvement.

- It charges a 2.5% service fee on all sales, with buyers responsible for NFT Gas Fees.

- Rarible features “lazy minting,” allowing creators to mint NFTs without upfront NFT Gas Fees; these fees are paid by buyers upon purchase.

- The platform also implements the “Royalties” feature, allowing creators to earn a percentage of the resale price of their NFTs.

LooksRare

- LooksRare is a newer NFT marketplace known for its rewards program.

- It charges a 2% service fee on sales, and buyers cover NFT Gas Fees.

- A unique feature is “WETH rewards,” where buyers using Wrapped Ethereum (WETH) receive LOOKS tokens as rewards, which can be used for NFT Gas Fees or traded for other cryptocurrencies.

Foundation

- Foundation is a curated NFT marketplace focusing on high-quality digital art.

- It is selective, with artists requiring invitations to participate.

- Foundation charges a 15% service fee on all sales but does not burden buyers with NFT Gas Fees.

SuperRare

- SuperRare is another curated NFT marketplace specializing in high-quality digital art.

- Artists must be invited to participate, similar to Foundation.

- While it charges a 15% service fee on sales, SuperRare only imposes NFT Gas Fees on buyers for their first NFT purchase on the platform.

Magic Eden

- Magic Eden charges a service fee of 2% on the total sales made on its marketplace.

- When it comes to NFT Gas Fees, buyers are responsible for covering these costs for their transactions on Magic Eden.

Future of NFT Gas Fees

NFTs continue to dominate the digital landscape, but the question of NFT Gas Fees remains a crucial concern. NFT Gas Fees, the transaction costs associated with NFTs on the Ethereum Blockchain, have been a topic of debate and innovation.

The Emergence of Layer-2 Solutions

One notable trend in addressing NFT Gas Fees is the development of Layer-2 solutions. While still evolving, these technologies have the potential to democratize NFT access by reducing transaction costs. Solutions like Optimistic Rollups and zk-Rollups have gained traction. They operate by processing a large volume of transactions off the Ethereum mainnet, maintaining security while drastically cutting NFT Gas Fees. These developments hold the promise of making NFTs more affordable for a broader audience.

Ethereum 2.0: A Game-Changer on the Horizon

The Ethereum Blockchain is in the midst of a significant transformation with Ethereum 2.0. This upgrade, although without a concrete completion date, carries the potential to bring about a substantial reduction in NFT Gas Fees. Ethereum 2.0’s transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism is expected to reduce energy consumption and boost transaction throughput. The resultant effect could be substantially lower NFT Gas Fees, making NFTs more accessible to users.

Trends in the NFT Market

NFTs have continued their remarkable ascent, supported by impressive statistics:

- Explosive Market Growth: In 2021, the global NFT market reached a staggering valuation of $15.7 billion. Projections indicate that this growth is far from over, with expectations set at a remarkable $81.5 billion by 2028. This meteoric rise underscores the enduring appeal and potential of NFTs across various sectors.

- Surging Sales Volume: The first quarter of 2023 witnessed a substantial surge in NFT sales volume, soaring to an impressive $4.54 billion. This is a significant jump from the same period in 2022 when NFT sales stood at $1.97 billion. Such rapid growth indicates the increasing adoption and engagement with NFTs across the digital ecosystem.

- Rising NFT Prices: Notably, the average price of an NFT has also seen a substantial increase. In Q4 of 2021, the average NFT price was $587. However, by Q1 of 2022, this figure had surged to $1,057. This substantial price appreciation illustrates the growing value and recognition of NFTs as unique digital assets.

Regulatory Impact

The regulatory landscape for NFTs is still in its nascent stages, with governments worldwide grappling to comprehend the technology and its implications. However, discernible trends are beginning to emerge.

One notable trend is the growing acknowledgment by governments of the potential economic opportunities and innovative possibilities presented by NFTs. To illustrate, the United Arab Emirates has launched several initiatives aimed at fostering NFT adoption. Notably, they’ve established a regulatory sandbox designed specifically for NFT businesses, exemplifying their commitment to nurturing this burgeoning sector.

Conversely, governments are also expressing apprehensions regarding the inherent risks associated with NFTs, such as money laundering and fraud. For instance, the US Securities and Exchange Commission (SEC) has issued cautionary statements to investors, highlighting the risks associated with investing in NFTs. Similarly, the UK Financial Conduct Authority (FCA) has categorically labeled NFTs as “high-risk” investments, urging consumers to exercise caution when considering investments in this space.

Now, let’s delve into specific examples of how different countries are approaching the regulatory aspect of NFTs:

- United States: The SEC has gone on record to warn investors about the potential hazards associated with NFT investments. They’ve also indicated that certain NFTs might fall under the purview of securities regulations, subjecting them to legal oversight.

- United Kingdom: The FCA, echoing similar concerns, has explicitly tagged NFTs as “high-risk” investments, sounding a note of caution for consumers.

- European Union: The EU is currently in the process of crafting a regulatory framework for cryptocurrencies, and this framework may encompass NFTs, subjecting them to regulatory scrutiny.

- China: China has taken a strict stance on cryptocurrency trading and mining, effectively banning these activities. The implications of this ban on the NFT market in China remain uncertain.

In addition to these trends, it’s worth noting some relevant statistics and facts:

- A recent survey by Deloitte found that 60% of financial services executives believe that NFTs will be regulated within the next two years.

- The same survey found that 70% of financial services executives believe that regulation is necessary to protect investors and consumers.

- A report by the World Economic Forum found that NFTs are most likely to be regulated in areas such as securities law, anti-money laundering (AML), and consumer protection.

Predictions and Speculations

As the NFT landscape continues to evolve, industry experts and stakeholders are making predictions and speculations about its future. Here are some key insights:

- Market Trends: The current market trends related to NFT Gas Fees suggest that users are becoming increasingly conscious of the costs associated with creating, buying, and trading NFTs. This awareness may drive innovation in reducing NFT Gas Fees.

- Expert Opinions: Experts in the Blockchain and NFT space foresee several potential developments. They believe that advancements in Blockchain technology, such as the widespread adoption of Layer 2 solutions, will likely alleviate the high NFT Gas Fees currently experienced by users.

- Technological Advancements: The ongoing development of Layer 2 solutions, which aim to enhance the scalability and efficiency of Blockchain networks, could have a significant impact on NFT Gas Fees. These solutions promise faster and more cost-effective transactions, making NFTs more accessible to a broader audience.

- Investor Sentiment: Investor sentiment remains a critical factor. Many investors and collectors are willing to pay higher NFT Gas Fees for exclusive or highly sought-after NFTs. However, as the market matures, there may be a shift towards more cost-conscious decisions.

- Environmental Concerns: Another emerging trend is the increasing focus on the environmental impact of Blockchain networks and NFT transactions. Some speculate that environmentally friendly Blockchains may gain traction, potentially affecting gas fee dynamics.

- Regulatory Developments: As mentioned earlier, regulatory frameworks are evolving. It is speculated that regulators will continue to shape the NFT landscape, potentially introducing rules aimed at protecting investors and ensuring compliance.

Conclusion

As we conclude the article, you must have already got the answers to the burning questions: “What is NFT Gas Fee and how to calculate it?” Understanding NFT Gas Fees and how to calculate them is vital for anyone diving into the world of NFTs. These fees are the unsung heroes, powering the Blockchain transactions that make NFT ownership possible. By grasping the concepts behind NFT gas fees and following the steps to calculate them, you can navigate the NFT space with confidence. Remember, as a beginner or a seasoned pro, staying informed about the technical aspects of NFTs is the key to making informed decisions in this exciting digital landscape.

Frequently Asked Questions

What exactly are NFT Gas Fees?

- NFT Gas Fees are the charges incurred for processing transactions on the Blockchain.

- They are paid in cryptocurrency and compensate the miners who validate and include your transaction in a block.

- Gas fees are essential for maintaining the security and integrity of Blockchain networks.

- They prevent spam and ensure that miners have an incentive to include your transaction in a timely manner.

How can I calculate NFT Gas Fees?

- You can calculate gas fees using tools like Etherscan or wallet interfaces.

- Simply enter the details of your transaction, and these tools will estimate the gas cost based on current network conditions.

- Yes, you can adjust your gas fee by choosing a different gas price.

- This article covers the tips and strategies to reduce NFT Gas Fees

Guides

Guides News

News Blockchain

Blockchain Cryptocurrency

& Digital Assets

Cryptocurrency

& Digital Assets Web3

Web3 Metaverse & NFTs

Metaverse & NFTs